On the website of an unknown merchant, have you ever been forced to enter sensitive payment information? Would you be willing to hand over passwords or information about your credit card to someone you don’t trust? Researchers from the College of Vienna have now planned a genuinely solid framework for shopping in such settings, consolidating current cryptographic strategies with the essential properties of quantum light. Nature Communications has published a demonstration of these “quantum-digital payments” in a real-world setting.

In many areas of our daily lives, physical banknotes have been replaced by digital payments. They should be easy to use, unique, tamper-proof, and untraceable, just like banknotes, but they should also withstand digital attackers and data breaches.

In the present biological system, clients’ delicate information is subbed by successions of irregular numbers, and the uniqueness of every exchange is gotten by an old-style cryptographic strategy or code. However, adversaries and businesses with substantial computational resources are able to decipher these codes, recover the private data of customers, and, for instance, make payments in their names.

“At the moment, our protocol requires a few minutes of quantum communication to complete a transaction. This is to ensure security in the presence of noise and losses.”

Peter Schiansky, first author of the paper.

Prof. Philip Walther, a member of the University of Vienna’s research team, has demonstrated how the quantum properties of light particles, also known as photons, can guarantee complete security for digital payments.

The researchers have demonstrated in an experiment that the user’s sensitive data remains private and that no transaction can be duplicated or diverted by malicious parties. Tobias Guggemos says, “I am really impressed how the quantum properties of light can be used to protect new applications like digital payments that are relevant to our day-to-day lives.”

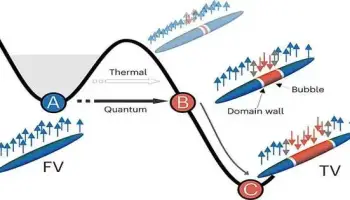

For outright secure computerized installments, the researchers supplanted traditional cryptographic strategies with a quantum convention taking advantage of single photons. The client shares a classical code, known as a cryptogram, with his payment provider (such as a bank or credit card company) during a traditional digital payment transaction.

The customer, merchant, and payment provider then exchange this cryptogram. This cryptogram is created in the demonstrated quantum protocol by having the payment service send the client specially prepared single photons.

For the installment strategy, the client estimates these photons, and the estimation settings rely on the exchange boundaries. The transaction can only be carried out once because quantum states of light cannot be duplicated. This, in addition to the fact that any deviation from the intended payment alters the measurement results, which are verified by the payment provider, guarantees that this digital payment is secure.

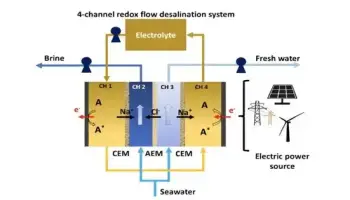

Over a 641-meter urban optical fiber link connecting two university buildings in Vienna’s downtown, the researchers were able to successfully implement quantum-digital payments. Computerized installments, as of now, work within a couple of moments.

“A transaction can be completed using our protocol right now after a few minutes of quantum communication.” This is to ensure safety in the face of noise and losses,” says Peter Schiansky, the paper’s first author. “We will witness that quantum-digital payments reach practical performance in the very near future,” says Matthieu Bozzio, who adds that “these time limitations are only of a technological nature.”

More information: Peter Schiansky et al, Demonstration of quantum-digital payments, Nature Communications (2023). DOI: 10.1038/s41467-023-39519-w