Despite the fact that satellite internet has been around for a long time, the rivalry is likely to heat up, with competitors intending to launch thousands of their own systems into low Earth orbit.

Amazon made the most recent move in the industry on Tuesday, inking arrangements with three rocket companies in order to get its $10 billion Kuiper constellation off the ground.

The US online retail behemoth wants to expand its lucrative IT services division and “offer low-latency broadband to a wide spectrum of clients,” including those “working in regions where a dependable internet connection is unavailable.”

“Satellite technologies are an essential complement to fiber,” said Stephane Israel, CEO of Arianespace, one of Amazon’s rocket manufacturers.

“Satellite solutions are an indispensable complement to fiber,”

Stephane Israel, chief executive of Arianespace

He noted that “fiber is substantially more expensive than satellite connections in some cases,” he noted, “particularly to reach the last inhabitant of a rural location.”

Amazon intends “compact, affordable client terminals” similar to Echo smart-homes and Kindle e-readers, in addition to the satellites themselves, and pledges to “deliver service at a price that is affordable and accessible to customers,” though no pricing specifics have been released yet.

Will Amazon be able to compete in a market that is becoming increasingly crowded?

Clients in the United States can utilize HughesNet and Viasat, while in Europe, Orange subsidiary Nordnet, among others, uses the Eutelsat Konnect satellite to provide broadband to its customers.

Users’ monthly costs, excluding terminal and antenna, begin at about 60 euros ($70) and rise in accordance with bandwidth.

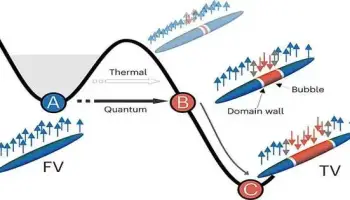

However, because these services rely on satellites in geostationary orbit, which is more than 35,000 kilometers (22,000 miles) above the Earth’s surface, their speed cannot equal that of fiber, making them unsuitable for high-speed jobs such as gaming.

Future Amazon satellites, like those launched by Starlink, a SpaceX subsidiary, will operate in low Earth orbit (LEO), which is only 600 kilometers high.

Low-orbit objects are more vulnerable.

“You can optimize the uses by reducing latency,” Israel explained.

Being closer to Earth, on the other hand, necessitates the launch of many more spacecraft: around 3,200 for Amazon and thousands for Starlink, of which over 1,500 are already operational.

China aims to install roughly 13,000 “GuoWang” satellites, with the British company OneWeb having launched 428 of the 648 satellites in its LEO network.

Aside from national competitiveness concerns, the quick expansion is in response to an equally expanding need.

The International Telecommunication Union of the United Nations stated in late March that “internet connectivity, formerly considered a luxury, became critical for many during the COVID-19 epidemic as populations faced stay-at-home orders and many practices shifted online.”

“The need for bandwidth has exploded around the world, and we will never be able to launch enough satellites to supply it,” predicted one executive AFP met this week in Colorado Springs on the margins of the world’s largest space technology trade expo.

However, as seen by the recent loss of dozens of Starlinks due to a magnetic storm, the bandwidth marketing professional, who wished to remain anonymous, pointed out that low-orbiting spacecraft are significantly more fragile than geostationary satellites.

As a result, “they will have to be replaced on a regular basis.”