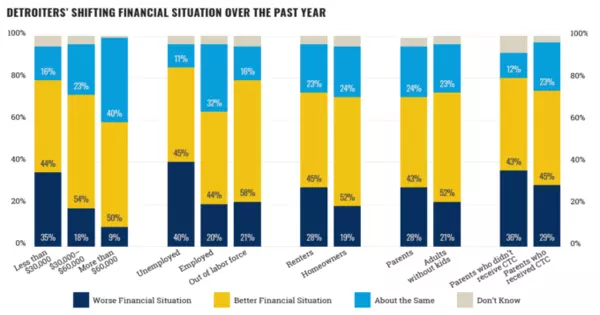

Two years into the pandemic, 72% of Detroit inhabitants say what is happening has balanced out or worked on contrasted with a year prior, and there’s proof that upgrade checks and the extended Child Tax Credit have played a part in diminishing Detroiters’ encounters with financial difficulty.

In any case, individuals with family livelihoods of under $30,000 were bound to express they’re in a more regrettable monetary circumstance than a year prior (35%), compared with individuals with salaries somewhere in the range of $30,000 and $60,000 (18%), and individuals making more than $60,000 (9%), as indicated by the latest overview from the University of Michigan’s Detroit Metro Area Communities Study.

“People with lower salaries, those who are unemployed, renters, and parents were more likely to report being in a worse financial situation at the end of 2021 than a year earlier, according to survey data. The economic impact of COVID-19 may have reinforced Detroit’s advantages and disadvantages.”

Lydia Wileden, DMACS research associate

“The overview information shows individuals with lower wages, individuals who are jobless, tenants, and guardians were bound to report being in a more regrettable monetary circumstance toward the end of 2021 than a year sooner. “The financial effects of COVID-19 might enjoy supported benefits and impediments in Detroit,” said Lydia Wileden, DMACS research partner who co-composed the new report.

The report’s discoveries come from a review of a delegate test of 1,900 Detroit occupants handled in November and December 2021.

Detroiters who got the monetary improvement installments were less inclined to report that they had faced major financial difficulties in the last year. Toward the end of 2021, 13% of improvement check beneficiaries said they were confronting major financial difficulties, compared with 30% of individuals who didn’t get the checks.

Likewise, guardians who got the Child Tax Credit, which circulated regularly scheduled installments of $250-$300 per youngster from July to December 2021, were altogether bound to report advanced monetary conditions compared with other qualified guardians, with 23% of CTC beneficiaries saying they are in a preferable monetary position now over a year prior, compared with 12% of guardians who were qualified yet didn’t get the tax break.

“There is proof that the extension of the COVID-19 security net helped facilitate inhabitants’ financial difficulties.” “Proceeding with this methodology of giving money help could assist families with keeping up with the monetary dependability they accomplished in the second year of the pandemic,” said Elisabeth Gerber, one of the staff leads for DMACS and teacher of public strategy at U-M.

The overview additionally found lodging costs are a critical component in Detroiters’ monetary prosperity. Lodging costs are viewed as reasonable in the event that they represent something like 30% of a family’s pay. In any case, in light of the overall reactions, an expected 39,000 Detroit families—33,000 tenant families and 6,000 property-holder families—are spending the greater part of their pay on lodging, which is viewed as a serious lodging problem.

33% of Detroit occupants said they had missed something like one lodging installment in the previous year, which increases their gamble of expulsion or dispossession. Five percent of Detroiters said they had been removed in the previous year, meaning an expected 13,000 families might have been dislodged from their homes in 2021; a big part of the detailed expulsions happened over the most recent four months of 2021 after the government ousting ban passed.

Furthermore, 17% of Detroiters announced encountering at least one utility or administrative shut-off somewhat recently, with the most well-known structure being the separation of telephone or network access.