Petroleum derivative organizations approach a dark lawful instrument that could risk overall endeavors to safeguard the environment, and they’re beginning to utilize it. The outcome could cost nations that press ahead with those endeavors billions of dollars.

Throughout the course of recent years, nations have marked a huge number of settlements that shield unfamiliar financial backers from government activities. These deals are like agreements between public states, intended to tempt financial backers to acquire projects with the guarantee of nearby positions and admittance to new innovations.

However, presently, as nations attempt to gradually transition away from petroleum derivatives to slow environmental change, these arrangements could leave the public confronting overpowering legal and monetary dangers.

The deals permit financial backers to sue legislatures for pay in a cycle called financial backer state debate settlement, or ISDS. So, financial backers could involve ISDS conditions to request pay because of government activities to restrict non-renewable energy sources, for example, dropping pipelines and denying boring licenses. For instance, TC Energy, a Canadian organization, is presently looking for more than US $15 billion over U.S. President Joe Biden’s dropping of the Keystone XL Pipeline.

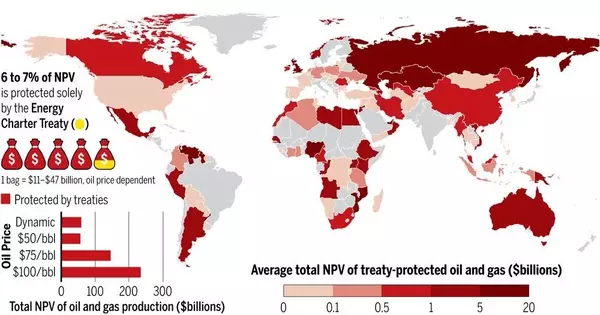

In a review distributed May 5, 2022, in the journal Science, we gauge that nations would face up to $340 billion in legitimate and monetary dangers for dropping petroleum derivative activities that are dependent upon deals with ISDS provisos.

That is more than nations put together in environmental change and alleviation estimates for fiscal year 2019, and it excludes the risks of gradually transitioning away from coal speculations or dropping petroleum derivative framework projects, for example, pipelines and condensed flammable gas terminals.It implies that cash nations could somehow spend to assemble a low-carbon future could rather go to the very businesses that have intentionally been energizing environmental change, seriously endangering nations’ ability to drive efficient power energy progress forward.

Huge potential payouts

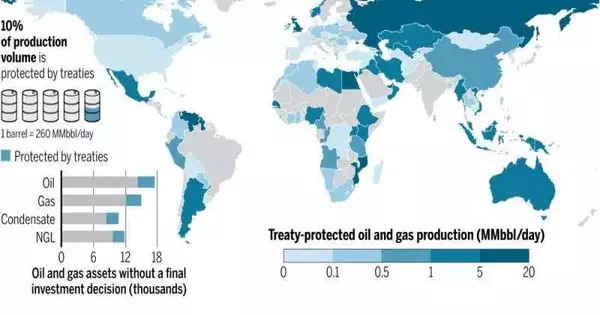

Of the world’s 55,206 upstream oil and gas projects that are in the beginning phases of advancement, we recognized 10,506 activities—19% of the aggregate—that were safeguarded by 334 arrangements giving admittance to ISDS.

That number could be a lot higher. We could recognize the central command of venture proprietors, not the general corporate designs of the speculations, because of restricted information. We also know that law firms are encouraging clients in the business to structure speculations to ensure admittance to ISDS, for example, by involving auxiliaries in countries with deal insurance.

Contingent on future oil and gas costs, we observed that the all-out net present worth of those undertakings is supposed to reach $60 billion to $234 billion. Assuming that nations drop these safeguarded projects, unfamiliar financial backers could sue for monetary remuneration in accordance with these valuations.

This would put a few low- and middle-income countries at serious risk.Mozambique, Guyana, and Venezuela could each face more than $20 billion in expected misfortune from ISDS claims.

Assuming nations additionally drop oil and gas projects that are further along in being developed but are not yet created, they face more risk. We viewed that as 12% of those ventures overall are safeguarded by speculation arrangements, and their financial backers could sue for $32 billion to $106 billion.

Dropping supported ventures could be especially hazardous for nations like Kazakhstan, which could lose $6 billion to $18 billion, and Indonesia, with $3 billion to $4 billion in danger.

Dropping coal ventures or petroleum derivative foundation projects, similar to pipelines and condensed flammable gas terminals, could prompt significantly more cases.

Nations are currently experiencing administrative paralysis.

There have been somewhere around 231 ISDS cases, including non-renewable energy sources, up until this point. The simple danger of huge payouts to financial backers could make numerous nations defer environmental alleviation arrangements, causing a purported “administrative chill.”

Both Denmark and New Zealand, for instance, appear to have planned their petroleum product phaseout designs explicitly to limit their openness to ISDS. Some environmental strategists speculated that Denmark may have chosen 2050 as the end date for oil and gas extraction to avoid conflict with existing exploration permit holders.

New Zealand prohibited all new seaward oil investigations in 2018. However, it dropped no current agreements. The environment service recognized that a more forceful arrangement “would have crossed paths with financial backer state settlements.” After the Canadian organization Vermilion took steps to send off an ISDS case, France overhauled a draft regulation restricting petroleum derivative extraction by 2040 and permitting the reestablishment of oil abuse grants.

Obtaining environmentally friendly energy progress

While these discoveries are disturbing, nations have choices to stay away from difficult legitimate and monetary dangers.

The Organization for Economic Cooperation and Development is presently examining a proposition on the eventual fate of speculation arrangements.

A direct methodology would be for nations to end or pull out of these deals. Several governments have expressed concern about the unanticipated consequences of abruptly ending speculation arrangements, yet other countries have done so proactively, with few or no genuine financial outcomes.

For more perplexing economic deals, nations can haggle to eliminate ISDS arrangements, as the United States and Canada did when they supplanted the North American Free Trade Agreement with the United States-Mexico-Canada Agreement.

Extra difficulties originate from “dusk provisions” that tight spot nations for 10 years or more after they have been removed from certain deals. Such is the situation for Italy, which pulled out of the Energy Charter Treaty in 2016. It is right now trapped in a continuous ISDS case started by the U.K. organization Rockhopper over a restriction on seaside oil boring.

The Energy Charter Treaty, an extraordinary speculation understanding covering the energy area, arose as the best single supporter of worldwide ISDS gambles in our dataset. Numerous European nations are right now thinking about whether to pass on the arrangement and how to stay away from a similar destiny as Italy. Assuming that all nations gathering to an agreement can agree to withdraw, they may be able to avoid the nightfall condition through shared understanding.

The world’s progress

Fighting environmental change isn’t modest. Activities by state-run administrations and the private sector are both expected to slow an unnatural weather change and hold it back from progressively wrecking calamities.

Finally, the question is who will pay — and be paid — for global energy progress. any rate, it would be counterproductive to redirect basic public money from fundamental relief and variation endeavors to the pockets of non-renewable energy source industry financial backers whose items caused the issue in any case.