Without guidelines for their utilization, the state of openly available assets, for example, fish stocks, water, or air, can crumble emphatically. In financial matters, this is alluded to as the “awfulness of the hall.” Elinor Ostrom became the first woman to receive the Nobel Prize in Economic Sciences in 2009 for her research on this topic. Ostrom’s inquiry of how to forestall this “misfortune” is similarly pertinent today as it was nearly a while ago.

The game hypothesis manages circumstances in which various specialists rival one another, with every member attempting to separately expand their own benefit. One discusses “Nash harmony” in the event that players can’t expand their profits further. The “Awfulness of the House” is a game-hypothetical situation where the entertainers don’t contend directly, yet by implication: in the event that somebody takes a slice of a typical pie, there will be less for every other person.

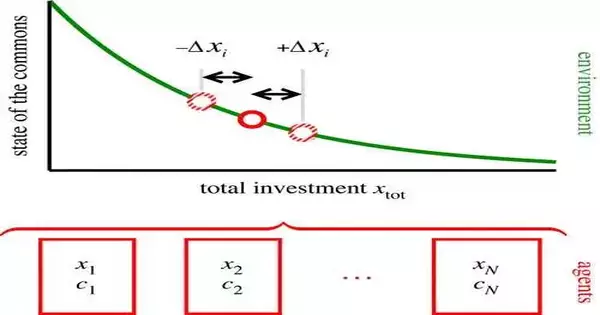

Rather than exploring how to keep away from the “awfulness of the center,” Claudius Gros from Goethe College’s Establishment for Hypothetical Material Science inspected the subsequent Nash balance, with surprising outcomes: In the event that a typical request is partitioned pretty much similarly among N closely involved individuals, then each gets a portion of the request divided by 1. Nonetheless, the particular venture costs actually should be deducted.

That’s what Gros’ estimations show, in balance, as the entertainers increment their commitment until the subsequent speculation costs nearly arrive at the worth of the assets the singular financial backer can get for her or himself. Numerically, the hypothetical physicist had the option to show that the last benefit of the singular financial backer scales as 1/N2.

The first assumption, that financial backers each get a relative offer from the asset, stays right, as Gros’ exploration shows. Nonetheless, this doesn’t translate into a general return of a similar extent, which is more modest in terms of the quantity of financial backers. Gros signifies the emotional crumbling of the net benefit as “devastating neediness,” as it suggests that unregulated rivalry drives the singular entertainer as close as possible to the resource level.

Additionally, Gros had the option to demonstrate the way that devastating destitution can be kept at bay when the entertainers help out one another. The traditional result of participation is a net benefit relative to the number of financial backers in basic power.

The aftereffect of the examinations is that “the awfulness of the hall” can cause significantly more harm than recently accepted. Unrestricted access not only leads to potentially unreasonable double-dealing of the asset, which has been the subject of numerous previous investigations. Likewise, financial backers endure themselves while just amplifying their own benefits.

Numerically, Gros had the option to show that mechanical advancement escalates this interaction and that either all or by far most of the participating financial backers are at last impacted by disastrous destitution. Regardless, a few financial backers—the oligarchs—stand to benefit.

The review is distributed in the Imperial Society Open Science journal.

More information: Claudius Gros, Generic catastrophic poverty when selfish investors exploit a degradable common resource, Royal Society Open Science (2023). DOI: 10.1098/rsos.221234